For Governments & State-Owned Entreprises

InvestorsStructuring and delivering large scale projects

- Overview

- Expertise

- Transactions

Overview

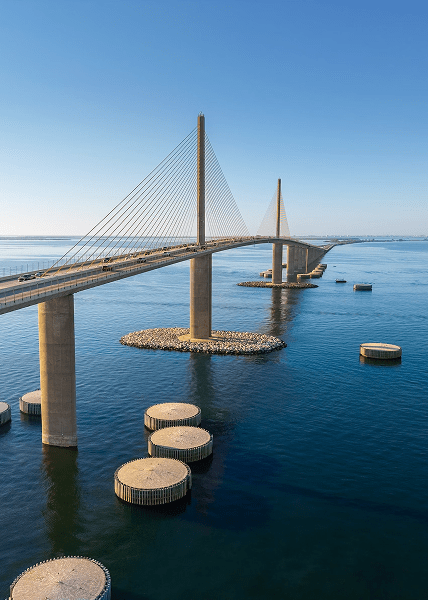

When African governments envision transformative infrastructure,

Capital of Africa delivers.

At Capital of Africa, we are trusted advisors to sovereigns and state-owned enterprises (SOEs), leveraging on decades of experience in structuring and delivering Africa’s most ambitious infrastructure projects. We align and bridge national priorities with sustainable, financially viable solutions, ensuring that critical projects move from concept to completion.

We specialize in early-stage project development, transforming complex infrastructure needs into bankable, well-structured deals that are technically sound and investor-ready. With an on-the-ground presence, we work directly with key stakeholders—developing technical frameworks, structuring term sheets and mobilizing financing that meets global standards.

We oversee the entire project lifecycle and provide comprehensive, end-to-end solutions—from concept to execution - managing risk, securing financing and ensuring timely, on-budget delivery.

Expertise

Feasibility Studies & Structuring

At Capital of Africa, our expertise in Feasibility Studies & Structuring empowers clients to make informed, strategic decisions. We conduct thorough market analyses, financial modeling, technical evaluations, and socio-economic impact assessments to determine project viability and define optimal structures for execution and financing.

Our distinctive approach identifies opportunities and challenges early, enabling strategic guidance that enhances project bankability, optimizes returns, and ensures seamless execution. By combining industry knowledge, local insights, and financial acumen, Capital of Africa delivers tailored solutions that drive sustainable success across diverse sectors.

Investment & Financing Mobilization

At Capital of Africa, we specialize in mobilizing strategic investment and financing solutions that drive transformative growth. Through our deep network of global investors, financial institutions, and development partners, we secure the right capital mix to meet the unique needs of each project.

Our services span the full investment lifecycle, from early-stage capital raising and structured financing to debt and equity placement. We design and implement innovative financing structures that optimize funding efficiency, mitigate risk, and enhance project value.

Our added value lies in our ability to align investor expectations with project realities, structuring transactions that are both financially sound and strategically impactful. Capital of Africa delivers bespoke financial solutions that unlock opportunities, accelerate development, and foster long-term success for our clients and partners.

Project Development & Implementation

At Capital of Africa, we transform ambitious visions into tangible, high-impact projects. Our Project Development & Implementation services cover every stage of the project lifecycle, from concept refinement and technical validation to execution oversight and operational readiness.

We work alongside our clients to structure projects effectively, secure strategic partnerships, and mobilize resources necessary for successful delivery. Our multidisciplinary teams combine strategic insight, technical expertise, and hands-on project management to navigate complexities and drive efficient execution.

Capital of Africa’s strength lies in our commitment to execution excellence. We anticipate challenges, adapt to changing conditions, and maintain a relentless focus on quality, timelines, and stakeholder alignment, ensuring that each project achieves its full potential and delivers lasting value.

Engineering, Procurement & Construction (EPC) Solutions

Capital of Africa offers integrated EPC solutions that bring projects from blueprint to reality with precision and efficiency. We partner with world-class engineering firms, procurement and sourcing specialists, and construction leaders to deliver turnkey projects that meet the highest standards of quality, safety, and performance.

With a deep understanding of the EPC landscape and the requirements of Export Credit Agencies (ECAs), we strategically structure and source projects to align with ECA expectations. This ensures smoother onboarding processes, facilitates access to competitive financing, and enhances the overall bankability of projects.

Across all sectors

Operating in Africa demands more than ambition — it requires a new mindset, a new skillset, and a deep understanding of both public sector constraints and private sector ambitions across the continent. Success lies in bridging these realities through innovative and expertly structured financing solutions.”

Khalil Chyat

-Founder & CEO

Recent Transactions

Djibouti’s strategic logistic expansion: Capital of Africa advises Djibouti Ports and Free Zone Authority and Great Horn Investment Holding on USD155 million structured financing for Damerjog Oil Terminal project

-

Djibouti

-

18 juillet 2023

-

USD 155 million

Capital of Africa and BOAD Co-Lead FCFA 60 Billion Transaction for PETROCI in Ivory Coast

-

Ivory Coast

-

24 juin 2024

-

FCFA 60 Billion