For investors

Governements & SOEsUnlocking Africa’s most promising opportunities

- Overview

- Expertise

- Transactions

Overview

We connect investors to Africa’s highest-potential, strategically sound ventures,

backed by deep market expertise and a powerful network.

Africa is one of the fastest-growing investment frontiers, yet navigating the complexities of deal structuring, risk mitigation, and execution remains a challenge.

At Capital of Africa, we believe in “Quality Assurance at Inception”. Each project undergoes rigorous screening, risk assessment and structuring to ensure alignment with investors’ strategic objectives.

With a single point of expertise, we streamline complex investment processes—from market entry and fund structuring to M&A, trade finance, structured and project finance.

Expertise

Deal Sourcing, M&A and Strategic Advisory

At Capital of Africa, we connect opportunities with vision. Our Deal Sourcing, M&A, and Strategic Advisory services are designed to unlock growth, create value, and drive strategic transformation for our clients across diverse sectors.

We identify high-potential investment and acquisition opportunities, leveraging our extensive network and local market expertise. From initial target screening and due diligence to negotiation support and post-transaction integration, we deliver end-to-end M&A advisory tailored to each client’s objectives.

Our strategic advisory offering provides actionable insights that help clients navigate complex market dynamics, optimize their portfolios, and position themselves for long-term success. Capital of Africa’s added value lies in our ability to combine global standards with local intelligence, delivering bespoke, high-impact solutions that maximize value creation and minimize execution risks.

Trade and Commodities Finance

At Capital of Africa, we empower trade flows and unlock value across the commodities supply chain. Our Trade and Commodities Finance services provide innovative, tailored solutions that facilitate cross-border transactions, optimize working capital, and manage risks effectively.

We support clients across key sectors including energy, mining, agriculture, and infrastructure by structuring financing that bridges production, processing, transportation, and sale. Our deep relationships with global banks, traders, and institutional investors enable us to mobilize liquidity and secure competitive financing terms.

Capital of Africa’s added value lies in our agility, sector expertise, and ability to structure transactions that align with both market realities and client strategies. By combining financial innovation with strong risk management, we help our clients accelerate trade, strengthen supply chains, and achieve sustainable growth.

Structured (ECAs/Asset), Corporate and Project Finance

At Capital of Africa, we deliver comprehensive financing solutions that power transformative projects and corporate growth. Our Structured Export (ECA), Corporate, and Project Finance services are designed to mobilize capital efficiently, align with international standards, and support sustainable development across the continent.

We leverage strong relationships with Export Credit Agencies, development finance institutions, and global banks to structure financing packages that mitigate risks, enhance credit profiles, and secure long-term funding. From corporate lending to large-scale infrastructure project financing, we tailor solutions that meet the unique needs and ambitions of our clients.

Capital of Africa’s added value lies in our ability to navigate complex financing ecosystems, align sourcing with ECA requirements, and deliver structures that optimize financial efficiency while ensuring project bankability. Our expertise drives projects from vision to execution, accelerating growth and impact across Africa.

Across all sectors

Operating in Africa demands more than ambition — it requires a new mindset, a new skillset, and a deep understanding of both public sector constraints and private sector ambitions across the continent. Success lies in bridging these realities through innovative and expertly structured financing solutions.”

Khalil Chyat

-Founder & CEO

Recent Transactions

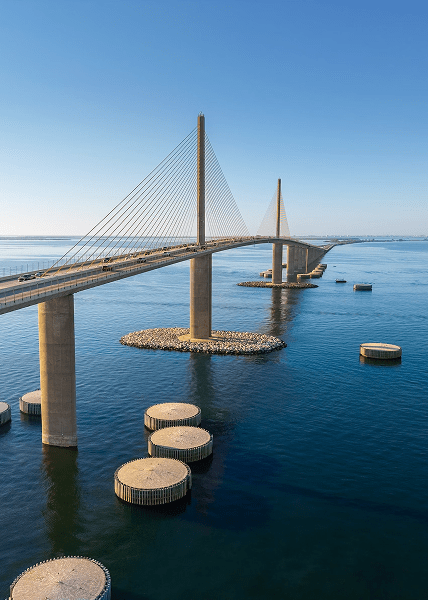

Djibouti’s strategic logistic expansion: Capital of Africa advises Djibouti Ports and Free Zone Authority and Great Horn Investment Holding on USD155 million structured financing for Damerjog Oil Terminal project

-

Djibouti

-

18 juillet 2023

-

USD 155 million

Capital of Africa and BOAD Co-Lead FCFA 60 Billion Transaction for PETROCI in Ivory Coast

-

Ivory Coast

-

24 juin 2024

-

FCFA 60 Billion